| 2015-02-27 |

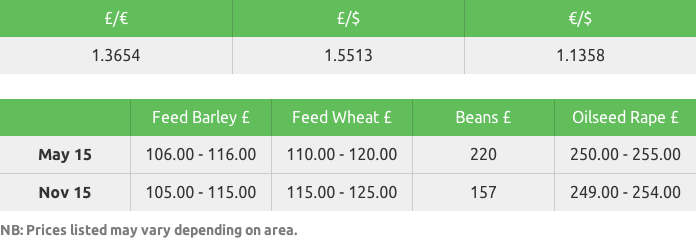

UK wheat prices have witnessed sharp losses over the week, pressured by further gains in sterling against the euro and the US dollar.

Feed Wheat

Following last week’s US wheat purchase cancellation, Egypt came back for another go and surprised the market by buying 290,000t, its largest single US acquisition for some time. The trade was for higher quality hard red winter (HRW) wheat rather than the usual soft red winter (SRW). While that may provide some level of support to the US quality market, it will also send ripples of concern to long-holders on the Chicago exchange, which is already suffering from US soft wheat’s lack of competitiveness. The purchase, using the US $100mln credit line, clearly demonstrates that Egypt needed some quality wheat to blend with EU / Black Sea supplies.

EU prices moved higher towards the end of last week on an improved export outlook, as North African buying lifted the MATIF. In addition, a large German wheat export programme is adding support, with trade estimates expecting 800,000t of wheat to be shipped in February, with about a further 1mln t to be loaded from German ports in March. Although EU wheat exports are running ahead of last season’s record pace, EU stocks are still projected to rise year-on-year, limiting any major price rallies. Rising bread prices may force additional export controls within Russia, and now this has extended into the Ukraine, where a major decline in the country’s currency is forcing up domestic wheat prices.

UK prices have witnessed sharp losses over the week, pressured by further gains in sterling against the euro and the US dollar. Despite continued interest from the major ports (loading existing sales) the rise in sterling has seen the UK become less competitive for further exports, both on an intra-EU and non-EU basis. In addition, signs of declining domestic demand (mainly from the ethanol sector), along with the general hand-to-mouth buying strategy of feed / flour producers, has reduced both delivery and quality premiums.

In summary, supplies remain abundant, and demand is starting to wane. The recent purchases by North Africa have all but finished exports to there until new crop, and any further Black Sea export restrictions will be of little impact to the market. With the USDA Outlook Forum projecting more than adequate US supplies through 2015/16, it will take a major weather or supply issue to provide the stimulus for a sustained price rally. Politics can never be ruled out as a ‘game-changer’ and with concerns still apparent over new crop conditions in parts of Russia and the Ukraine, what export policy both countries adopt after June 30th will either make or break the new crop market. But, knowing what we know at present, the likelihood is still for further declines in farm prices, for both old and new crop.

Rapeseed

The market was surprised by the views of the USDA’s outlook conference last week, with its forecast for a near-unchanged soy area. Most were looking for a lower corn area and a higher soy acreage, but despite this drop in projected plantings the USDA still showed a higher US 2015/16 carryout on soy and did nothing to undermine the bearish fundamentals on the soy market.

In Europe the market continues to track sideways and has been stuck in a narrow trading range on the MATIF for the past 4 weeks. Currency has had the biggest impact on UK farm gate prices, with sterling strength continuing to undermine values, and whilst there has been some spot demand from shorts, there is little to suggest any fundamental reason for a rally in old crop European rapeseed prices.

Looking to new crop, farmer selling across Europe is slow. Plantings suggest that European production will show a small decline this year, but this is likely to be offset by lower crusher demand (poor rapeseed crush vs. soy processing margins) and higher old crop carryout. Given the current outlook we need to see a weather or political event between now and harvest if UK rapeseed prices are to move significantly higher.

Malting Barley

Crop 2014/15 buying interest has dried up and premiums are very small with only the occasional trade short bringing any attention to the market.

Crop 2015/16 prices have continued to weaken, pressured by the firmer currency and pulled in line with the overall fundamental bearish sentiment of the wider grain market.

Despite weakening prices of late, solid new crop premiums are still available and many growers are choosing to contract tonnages at these levels.

The forecast for an increased UK and EU spring barley area has generated buying interest but this has been met by a lack of sellers, bringing some support for EU prices.

Gleadell has a wide variety of malting barley contracts available for crop 2015/16.

Feed Barley

This week has again continued to see barley values move weaker, tracking the wider grains market.

Export business has been restricted by a lack of demand (Chinese buyers returned from New Year’s celebrations on the 25th).

Competition for big port business continues to be strong, with Black Sea barley now looking comparatively cheap.

Volatile currency is also playing its part, making smaller export tonnages such as coaster-sized vessels uncompetitive into Europe.

Domestic consumers continue to cover small top-up tonnages as barley becomes more affordable for ration use, although barley still remains expensive when compared to wheat.

Growers would be advised to discuss new crop options for feed barley with

their Gleadell Farm trader ahead of what is expected to be another large barley

crop.

Oats

Supply is not jumping out of the woodwork and this may be in part due to increased usage on the farm.

Prices have eased back which makes this product a good value feed source and, as movement is now sluggish in the spot positions, feeding on the farm becomes a sensible option.

There still seems to be uncertainty as to the expected level of spring oat plantings.

Pulses

Feed bean demand for March–June again pushed prices firmer as supply continues to be limited.

Human consumption material also remains difficult to buy, but as the UK seems to be coming to the end of its bulk shipment programme, values could tail away.

Egypt is reluctant to buy new crop beans whilst internal restrictions remain in place with regard to local currency.

Values for new crop beans remain linked to LIFFE wheat, pushing values for feed beans ex farm to £155-160/t.

Seed

Spring seed is still in good demand. Popular barley varieties such as Concerto, Odyssey and KWS Irina remain available as well as Propino, although this tonnage is limited. New variety RGT Planet remains available and Gleadell is looking for further acreage for trial and evaluation test material from harvest 2015.

Due to the new EFA regulations many growers are now looking to grow pulses. We can offer a limited quantity of Daytona peas as well as Fanfare and Vertigo beans.

Gleadell has many new and exciting varieties for Autumn 2015 especially within the oilseed rape portfolio. Campus, “the seed with speed”, is new to the 2015/16 Recommended List, after topping many of the trials for gross output amongst the conventional lines. Campus has a solid all round package with high oil content, gross output and a good disease portfolio.

DK Exalte is another variety with a solid all-round package with excellent disease resistance including double phoma resistance, pod shatter resistance and good light leaf spot resistance.

Farmer favourite Incentive, which was very popular in 2014, remains available this season. Incentive has medium maturity and rapid autumn development, combined with a high yield potential and good oil content.

For further details and contract terms, including delayed payment offers, please contact your Gleadell Farm Trader.

Fertiliser

Urea

With minimal fresh news since last week, the global market is flat and lacks

any direction. In Europe and the US values remain unchanged as no deals for

prompt shipments have been concluded and farmer demand ahead of the approaching

application season continues to be moderate. Statistics would suggest there

is a huge amount of business to be concluded in all areas but it will take

the start of applications to bring this demand to the surface and it will

then be a case of available transport and product. In the UK, with the weather

remaining cool and wet we are already behind on applications but the inclusion

of urea for at least one dressing is being considered by many, not just in

the Eastern arable sector but also into the Western grassland areas. Gleadell

has quality granular and prilled urea in store for prompt delivery.

Ammonium nitrate

Demand remains slow, but there is still approximately 35% of the UK nitrogen

market to be covered, so demand in March, April and May will be huge. Pricing

levels for both UK and imported product are firm, but logistics are the real

issue and with the lack of availability of Fertiliser Industry Assurance

Scheme registered hauliers, ordering as soon as possible, would be our advice.

NPK/PK

Blenders and merchants had previously been squeezed as they continued to compete

for tonnes, but with firming replacement prices on N, P and K, all prices

have now moved higher for March and April deliveries. Further increases in

both compounds and blended products are expected. For more information on

available grades and delivery, please contact your local Gleadell Farm Trader.

ENhancePro – Foliar N Spray

Ensuring milling wheat protein levels meet specification

will be very important this season given the lower grain prices. With new,

higher yielding varieties like Skyfall, protein dilution becomes

a possibility, so nitrogen application programmes will need to reflect

this. This year the milling wheat acreage is up by nearly 5% on last

year for NABIM Group 1 varieties, and investing in a leaf tissue

analysis which will give you an indication on whether more nitrogen

is needed at GS 69-75 to help maximise milling premiums. Gleadell

offers a free leaf tissue analysis to all their milling wheat customers

and can then recommend on any EnhancePro applications required. Please

contact your local Gleadell Farm Trader or the fertiliser department

on 01427 421244 for more details.