| 2014-08-21 |

The UK harvest is now turned into a ‘stop-start’ affair as growers dodge showers in order to harvest crops. With regional differences on the volume harvested, spot markets are driven by who wants the wheat, who has the wheat, and who can get the transport.

Feed Wheat

Another week of rumour and counter rumour, as earlier reports of potential crop losses due to the Ukraine and talk of export restrictions from the Black Sea region, were quashed the following day leaving the markets to give back, and some more, the previous day’s gains. US markets have also been watching reports of the crop tours across the key US corn growing states, which are mostly reporting the likelihood of bumper yields. This should provide enough data to see an increase in the USDA yield number in September.

EU markets have retraced back to trading just above contract lows, as traders are still trying to work out what quality the EU has! With reports that 30% of the German crop is still in the field there are increased concerns over the final quality, and potentially raises the volume of ‘feed grade’ wheat within the EU. The quality issue also seems to have spread east into the Ukraine, where 40% of their crop is reported as only feed quality, and also partially into Russia – it will be interesting at the next GASC tender – who offers the spec and at what price!

The UK harvest is now turned into a ‘stop-start’ affair as growers dodge showers in order to harvest crops. With regional differences on the volume harvested, spot markets are driven by who wants the wheat, who has the wheat, and who can get the transport. Further delays due to the wetter conditions increases the loss of quality risk, with in some areas over 50% still left uncut.

In summary, there is very little fresh news to talk about – crops aren’t getting smaller, but quality remain a key factor. Tightening of Black Sea financing, combined with a currency low, should continue to see increased farmer selling in order to obtain cash. Which in the long-term could play a major role in the 2015/16 planting campaign – do farmers have enough finance to plant and grow a crop? - As mentioned last week, markets have retested contract lows, but seem reluctant to push lower…. for the moment!

Rapeseed

In the US, weather continues to remain favourable for soybeans and with crop tour reports favourable there is little bullish impetus for soybeans.

In Europe crush margins are at acceptable levels for August/September but we don’t see large volumes of farmer selling anywhere - there is enough volume coming forward to cover shorts but not enough to significantly pressure prices. At present it feels like the market is a stand-off between crushers unwilling to pay higher prices and farmers unwilling to sell volume at these levels.

In the UK the physical market has firmed purely driven by short covering merchants but liquidity is a problem with a lack of seed coming off farm.

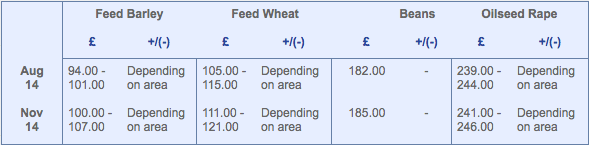

Feed Barley

Feed barley values for August and September have continued to move in-line with feed wheat prices over the past week.

Domestic consumers are offering short-term barley values very little support as they remain largely out of the market.

Yield reports in the UK and across key regions of Europe continue to be positive for the later cut spring barleys, following on from high yields for winters too.

Improved export demand from North Africa for European barley is providing some support for barley prices beyond harvest.

Regions close to ports have seen the discount to wheat narrow to within £10.

Malting Barley

The EU malting barley harvest draws to a close as Scotland and Sweden are the last main areas to complete harvest.

North East Scotland continues to see its harvest disrupted by frequent rain, although no quality problems have been seen so far.

The EU is going to have a large winter malting barley surplus.

Malting barley exports to China are expected again this year as usage remains strong.

Most UK growers have contract overages which are filling domestic markets as they appear.

There is good demand for both domestic and export markets in the new year.

Gleadell have a requirement for high nitrogen springs.

Buyback contracts are available on both Winter and Spring varieties to suit all risk profiles.

Pulses

Harvesting of beans can be a slow process - winter samples tested so far are disappointing with high beetle damage, high stain and high broken and split but we think this reflects the poorer land. First samples analysed from the spring varieties are looking more positive both in yield and quality.

Markets are stagnant as reported last week, with no real buying interest or sellers at present, we believe that the premiums over wheat are still too high, and that we will have to see a correction at some stage. This will probably be when more material comes to the market.

Free market uncontracted peas are difficult to find buying interest for as processors take stock of contracted material.

Seed

Gleadell remain in a strong position to be able to offer quick delivery for growers looking to drill oilseed rape this year. We are able to offer both the highest yielding hybrid and conventional varieties which are topping the trials tables this year. With yield stability throughout the UK, Incentive is the highest yielding hybrid on the 2014/15 Recommended List, making it very popular with growers. Its solid all round package, high oil content and great disease resistance have all helped it to shine through in trials. Campus, from KWS, has also performed well – Campus currently sits on the candidate list but has been topping the trials for gross output and excellent tolerance to verticillium wilt, as well as having a solid oil content and sound agronomics. New hybrid SY Harnas looks to be a strong contender for recommendation in 2015/2016 as it has performed well in trials, seed is available this year however this is limited.

With disease pressures being an ever present in today’s changing climate, it has been interesting to see how wheat varieties have fared in untreated trials. Early results show Cougar, Revelation and Evolution to be leading the way, as they have still performed well under these disease pressures. As well as excellent disease resistance, Evolution has consistency of yield over regions and years as well as good standing power. Revelation stocks are becoming tight from suppliers so we would urge growers to cover their requirements quickly in order to avoid disappointment. For growers who are wanting to out compete blackgrass, Belepi is a new soft wheat variety that has very vigorous spring growth – Belepi will be marketed outside of the Recommended List.

Fertiliser

Urea

Markets have continued to move higher this week with Urea trading up another $18 to $370+ FOB Egypt. This represents an on farm UK price of £290/t delivered and follows the gas supply problems in Egypt, political unrest in the Ukraine, the US continuing their buying spree and India announcing that they will enter the market soon with another tender. In the UK, 50% of the Urea market is covered and the likelihood is that buyers will now take a step backwards and watch to see where the market heads in Q4 before returning to buy their final requirements. In a volatile market anything can happen but events may suggest that we have already seen the bottom this season, the market has to now correct by $80 tonne to return to the values last seen in May this year.

AN

The market has suddenly started to move following a gradual realisation that logistical problems lie ahead. Yara have posted new prices in Europe, with ammonia, CAN and AN levels all now established on a firm base and stepped increases are likely from as early as September. Ammonia ultimately decides the direction for the ammonium nitrate market and over the last few weeks we have seen this market tick higher by $50 tonne. Pricing for AN is still over £40 tonne cheaper than those being quoted in Spring this year, so it is suggested that some cover is locked in before autumn price increases. Imported ammonium nitrate, after remaining flat for over 3 months, has also followed with many importers posting prices higher this week by over £5/t and forecasting higher numbers for Sept / October arrival.

SKW Alzon 46

A product used widely in Germany and a new approach being adopted by many now in the UK. The stabilised nitrogen fertiliser is environmentally friendly, involves less work and can be included in any fertiliser programme. So if you are planning your options for next year this is a product which should be given some consideration and with urea prices firm, Alzon is well priced compared with competitor products.

SKW Piamon 33-S

A Granular fertiliser unique to Gleadell in the UK, with the 33N + 30SO3 analysis and guaranteed quality this product will suit most arable farm demands. The £/€ rate makes this an extremely competitively priced product when compared to other N + S granular fertilisers on the market, while the October and November delivery period with a later payment makes this an even more attractive buy.

Phosphates

As with urea, India and the US continue to buy significant quantities of phosphates, willing to pay higher numbers on every trade, pushing this market higher. Several vessels of DAP have been sold this week into India with an estimated 2 Million tonnes of DAP required for this year. In the UK, TSP and DAP prices edge higher on tighter supply and increased demand as growers cover their autumn requirement.