| 2013-07-25 |

The GB 2013/14 wheat crop area is reported at 1.61mln hectares, down 19% year-on-year due to adverse weather.

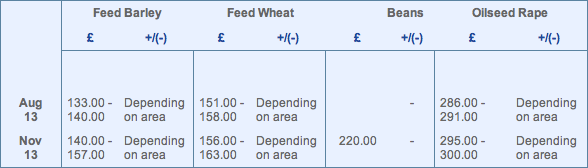

Feed Wheat

Markets remain under pressure, as relatively benign US weather dominates price direction. Earlier forecasts of hotter weather entering the US corn belt at the key pollination stage have been replaced with cooler, wetter conditions, ‘almost ideal’ for crop development. This has resulted in corn prices trading at their lowest levels since 2010 on the assumption that yield, and output could rise dragging wheat prices down in its wake. Although there has been recent support for wheat, with increased buying activity from China and Egypt, and recent crop rating concern over the US spring wheat crop, adequate stocks levels provides little long-term support, especially with the likelihood of increased corn supplies.

EU markets have again tested contract lows, reacting to weaker global markets. EU prospects continue to improve as harvest continues , and with recent Egyptian tenders placing Romanian and Black sea supplies at a hefty discount to French this could set the tone for a different export picture to last season. Early French cut wheat is reported with proteins falling below 11%, and even though this may improve as the harvest moves north, the market has already built in a protein (export) premium.

In the UK, the release by DEFRA placing the GB wheat area at 1.61mln hectares has done little to stop the bearish sentiment. Based on a 10% rise in yield, this would produce a wheat crop of around 11.8mln t, and whilst this is above earlier projections it would still be 1.5mln t below the 2012 output. Spot demand remains limited and with signs of increased sellers of old crop supplies, prices have fallen, currently trading at a relatively small premium to new crop values. The dynamics of the balance sheet could alter this season with the news that ENSUS has been sold and is likely to re-open some-time late summer/early Autumn. The extra demand, if wheat based, will increase the domestic demand for wheat, thus increasing import requirements.

Oats

The AHDB/HGCA results of the winter and spring oat area to be harvested put an increase of 32% into the pot over the harvest 2012 figure. This should give the oat miller a chance to select the preferred quality and could greatly reduce the need for imports from Scandinavia.

Uncertainty does however remain in some areas as the impact of the intense heat and continued heavy rain will not now be beneficial.

Oilseed Rape

We have seen US farmer selling pressuring soybean prices in the US and short term weather forecasts continue to point to favourable conditions in the key bean and corn growing areas.

The matif rapeseed contract and its physical derivatives of Oil & meal have continued to come under pressure as the harvest in Europe gets under way. We are also hearing early reports of good oil content and big crops from the Black sea regions.

The UK domestic market remains reasonably quiet with farmers still reluctant to sell. We feel farmers that require cash flow and harvest movement may be forced to sell and could therefore face potentially lower prices as harvest pressure erodes prices.

Malting Barley

The UK winter barley harvest has begun although recent rains have proved disruptive to progress and provided little if any benefit to winter crops. Early indications for yield and quality look positive.

Spring barleys are looking in good condition across most regions. There has been some burn-off reported on light land but after 19 days of temperatures around and above 30̊c this is not a surprise. Recent rains should prove beneficial for most crops.

Barley harvests continue across Europe with good quality reported in most areas, although recent crop tours in Germany brought some concern with crop condition worse than first thought. This has been paired with further hot temperatures up to 37 ̊c this week which supported both FOB and domestic markets at the end of last week.

UK winter barley demand will be lower for both new-crop and the 2014 crop as home availability decreases. This is due to the increase in demand for distilling varieties and for Null-Lox from UK maltsters.

We can expect a much greater carry-over of spring barley to crop’14, due to the surplus we may see this year. Gleadell advise growers to contract their new crop barley sooner rather than later.

Pulses

Beans continue to defy gravity, as world values fall for wheat and corn bean premiums rise, which makes them one of the most expensive forms of protein available to consumers. The recent rains are only seen as good for pod fill and potentially higher yields.

The situation in Egypt remains fragile, but it would appear that a consortium of Middle Eastern states have agreed to support the new Egyptian interim government with a financial package of 12bln USD to replenish their food stocks.

We are getting reports of imminent pea harvesting as the hot weather has pushed the crop along. Expectations are positive with prospects for 2 mt per acre yields.

Seed

Early indications of yields on winter barley are promising, along with good quality in malting types and high spec weights on feed varieties.

Growers are looking at winter barley as a crop to spread risk, harvest workload and as the perfect entry for OSR. Particularly in the place of second wheats where yield potential (early reports of Volume yielding in excess of 10mt/ha) and straw value add up to an attractive gross margin.

The recent rains will have given growers of OSR more confidence in moisture for rape entry. Seed crops in the continent are now safely gathered and production and delivery are now imminent.

Gleadell are pleased to offer the new candidate variety Ginfizz, a new hybrid from RAGT, the variety has excellent gross output and good agronomist characters and is certain to see good demand, particularly when we start to get early trial results.

For those looking at shorter height hybrids there are a number of exciting new varieties, including the fully recommended variety Troy, from DSV, along with a couple of newer varieties PX109 and CW239D.

Gleadell also have a further range of varieties to suit individual farm situations, many available as overyeared for prompt deliveries, including Avatar, Compass, Excalibur and SY Fighter .

In many cases Gleadell will be able to offer OSR on a next day delivery service.

Fertiliser

Ammonium Nitrate

Ammonium nitrate remains unchanged for both spot imported AN and UK product. Values for September look to be increasing by an expected £3/t for UK product and replacement imported product.

Alzon

Values for Alzon 46 are currently unchanged, as it is a German manufactured product, coming from a stable domestic market. This has reduced the “premium” over standard granular urea, making Alzon 46 an interesting option. Delivery post-harvest, improved cash flow and reduced storage are real benefits of this product.

Urea

Global levels are stable to firm this week with minimal business concluded for a second week running. Egyptian urea trades have moved marginally over the last ten days, with August tonnes being booked at an increase of approx. $2-5 from last trades. More Chinese granular urea is being committed by traders, as availability is getting tight. UK demand has now slowed as the build-up for harvest is upon us. Spot values for port stock positions represent an excellent opportunity compared with replacement levels for Sept/Dec. In our opinion, taking a percentage of your urea requirement in July/Aug seems a sensible option as typical price trends would suggest elevated levels for September onwards.

P&K

Autumn demand for phosphate is coming forward with values currently at the lowest for the year. Currency has aided values into the UK this week, providing UK farmers with an opportunity to cover their requirements. The world Potash market is flat, with limited news and values unchanged. This is the low point for MOP demand through the year and values will firm towards the autumn.