| 2013-02-22 |

Wheat prices have been buffeted by wild currency moves worldwide and by rumours of Chinese buying – or the lack of it. In the EU the line-up of French vessels still looks sizeable but there are still fears that France will not meet it’s export target and will have carry out stocks that are larger than previously anticipated.

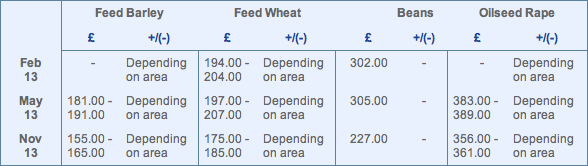

Feed Wheat

The debate about both the extent of plantings, the state of these plantings and therefore the size of the UK 2013 wheat crop has started in earnest, with potential crop sizes ranging between 10 mln mt and 12.6 mln mt. There is still some way to go till harvest with a lot of weather to be negotiated and therefore any estimate at this stage is at best a guesstimate. One thing that is becoming clear is that the UK will carry out over 2 mln mt of old crop wheat - a large number! This wheat is mostly of dubious quality and, in today’s terms, priced at £25 to £30 over new crop values, which makes carrying stock over to new crop financially unviable. This is not, on it’s own, at all supportive for old crop UK prices, and we still do need to export some of this tonnage between now and the end of June.

The market has been supported by rumours of China buying up to 1 mln mt of wheat from various origins. This rumour is not confirmed.

• Sterling has been extremely volatile this week, as has the Euro. Economic conditions both here and in Euroland remain uncertain, and currency has a large effect on both import and export parities.

• There has been little further news regarding Russia’s import demand. Much of the tonnage is expected to come from Kazakhstan.

• The latest customs information shows UK exports in December totalled 35,130 mt – giving a season total to the end of December of 512,129 mt ( of which Gleadell has shipped nearly 60pct ) . Imports of wheat in December totalled 305,584 mt, giving a season to date figure of 1.34mln mt. Also of note is the imported maize figure of 759,850 mt to the end of December, an increase of 300,000mt over the previous year with much of this extra tonnage rumoured to be aimed at the bioethanol plants.

Oats

The old crop market continues to drift as the end user edges closer to fulfilling his requirements for the year.

• The recent dry spell has allowed farmers on lighter land to begin work although spring barley may be sown before the oats.

• The likely oat acreage for harvest 2013 is difficult to gauge but the increased spring oat plantings hold the key.

Malting Barley

Old crop prices continue to weaken slightly on the export market as a result of a lack of significant demand.

• There are still long positions held in the trade, in both France and Scandinavia.

• Domestic prices haven’t fluctuated since last week, as maltsters continue to have reasonable demand for spring barley varieties.

• New crop malting premiums over feed barley have remained at around £15/t, but there are premiums for lower nitrogen barley available.

• Null-Lox (up to 1.92 nitrogen ) and distilling malting varieties (max 1.65 only) will be the key drivers for new crop, with distilling demand more than 10% higher for 13/14.

• Winter requirements will therefore be very tight – and growers are advised to book their winter movement as soon as possible or face the possibility that it will move as feed.

• Due to increased demand, Gleadell have a limited tonnage of premium-over-futures terms available for a limited tonnage of Null-Lox varieties Charmay and Cheerio. These are available for Jan-Mar movement.

• Gleadell’s winter and spring malting Pools are also still open, offering growers a competitive, low risk contract option.

• For our growers north of the M4, we still have seed available for the high yielding, low-GN distilling variety Overture.

Rapeseed

May13 matif rapeseed has gained around 10 euros this week tracking soybeans and canola higher. Soybeans have traded up towards the top of the recent range on Argentinian weather concerns, a lack of Argentinian farmer selling, logistical problems at Brazilian ports and renewed Chinese buying interest. At present the soybean market is trading within a range as we have a mixed picture of bullish and bearish factors.

• The big driver in domestic UK prices this week has been the weakness of Sterling against the Euro following the release of the Bank Of England minutes which revealed a potential move towards more quantitative easing, taking the FX market by surprise and adding £6-7 on domestic prices in a very short space of time. This currency move enabled some farmers to achieve £400 ex farm although the matif rapeseed contract remained fairly stable.

• The European physical market is fairly quiet with Australian seed still trading into the EU at discounts to European seed.

• The UK new crop market also remains quiet with farmers reluctant to sell forward with question marks over crop prospects.

Pulses

Old crop feed beans remain firm as the market continues to be short of supply, farmers are still holding back potential material waiting for the possibility of better drilling conditions.

• Weaker Currency has made Human Consumption beans look a more attractive buy for those middle-eastern buyers looking to purchase more stock prior to Ramadan.

• New crop feed bean values are holding at wheat plus £45/50pt, but the market is nervous with expectations of increased plantings.

• New crop pea seed stocks are virtually sold out, many buy back contracts have now been withdrawn other than marrowfats which remain a good alternative for late drilling.

Seed

We may see strong demand for any available spring seed if land looks like it will be suitable for drilling for which no seed cover has been taken. As a result of this we would continue to urge people to cover their requirements sooner rather than later.

• We have some additional Null-Lox seed that we can offer on the varieties Cheerio and Charmay with contracts available - other than these spring barley supply is now extremely limited.

• There has been some spot supply of spring wheat/beans and oats as suppliers finish their production runs. These have been quickly allocated to growers who have asked to be contacted once seed became available and we would recommend that this is a worthwhile exercise if you still have requirements.

• We still have a limited amount of marrowfat peas available on the varieties Kabuki and Neon with market leading buyback contracts, giving growers the best possible spring gross margin options.

• We still have availability of spring oilseed rape and linseed, along with the full range of grass seed/environmental mixtures and game cover seed.

• Anybody still looking to cover maize seed, we would urge them to do this as soon as possible as the season has been extremely early this time around.

• Looking forward to next autumn, Gleadell are offering an exciting new hybrid OSR variety called Ginfizz from RAGT. This variety has excellent gross output, early maturity and a solid disease package.

• In the barley sector, KWS Glacier takes 2 row feed barley to 6 row yields with good grain characteristics and solid agronomics. Seed availability of this variety will be extremely short, we have already seen strong demand so it is well worth covering your requirements if this is a variety of interest to you, further to this we can also offer the 6 row hybrid variety Volume on an open priced basis.

Fertiliser

Urea

The market remains firm and producers are comfortable for the foreseeable future.

• Demand into Europe continues as application starts.

• There has been no improvement in the gas supply position in North Africa and further, export availability continues to be cut by increased domestic commitments.

• There is more demand still to surface so there is little reason why prices will weaken in the short term.

• Gleadell have Granular and Prilled product available for delivery today.

Ammonium Nitrate/Sulphur

The replacement value of Imported AN in the UK has moved up reflecting further strengthening of the EURO vs. the UK £.

• Yara have moved CAN prices up in Europe.

• GrowHow are still holding prices but these are under constant review and we believe present a buying opportunity today.

• Ammonium Sulphate is also firm with limited availability in the UK and Europe for March.

Phosphates

Continued production cuts have helped to stabilise prices

• Fresh buying interest from Europe and several South American markets has surfaced.

• Values would appear to have now turned a corner and for the first time in months are showing definite signs of a recovery.

• Demand will arrive from India which will only help the recovery.

• TSP values are at a three year low so should be considered today.

Potash

Prices have bottomed out and producers have increased prices for Muriate of Potash with immediate effect.

• The outlook is for firming prices as spring demand increases.

• Proposals for the new Potash mine in North East England took another step forwards this week as plans were submitted to the North York Moors National Park.

Gleadell Bioenergy

This is an innovative service for owners and contractors of Anaerobic digestion (AD Plants).

• Gleadell Bioenergy provides energy growers with the best products for optimising the maximum methane yield.

• In partnership with KWS Energy maize seed we can offer the best terms for energy maize seed and energy beet.

• Piadin, a nitrogen stabiliser for farm slurry and digestate, reduces nitrous oxide emissions and leaching but increases yields by up to 11%.

• Gleadell support renewable energy and have the products to maximise yields whilst reducing costs.